ny highway use tax rates

Avalara can simplify fuel energy and motor tax rate calculation in multiple states. To calculate the tax you first need to find the total number of miles traveled on.

Nyc Dot Trucks And Commercial Vehicles

If you are receiving this message you have either attempted to use a bookmark without logging into your account or you have timed out.

. Use highway use tax web file to report. New York State imposes a highway use tax HUT on motor carriers operating certain motor vehicles on New York State public highways excluding toll-paid portions of the. IFTA Final Use Tax Rate and Rate Code Table 2 - 1st Quarter 2022.

IFTA-1051 722 Instructions on form. 22 rows IFTA Final Use Tax Rate and Rate Code Table 2 - 1st Quarter 2022. The highway use tax is computed by multiplying the number of miles traveled.

IFTA-1051 722 Instructions on form. The New York Highway Use Tax is calculated from a few factors but mileage is the most important part. New York imposes a highway use tax NY HUT or New York Highway Use Tax on motor carriers operating certain motor vehicles on New York State public highways excluding.

The highway use tax HUT is imposed on motor carriers operating motor vehicles on New York State public highways excluding toll-paid portions of the New York State Thruway. Highway Use Tax Web File You can only access this application through your Online Services account. The New York use tax should be paid for items bought tax-free over the internet bought while traveling or transported into New York from a state with a lower sales tax rate.

Ad Avalara solutions can help you determine energy and fuel excise tax with greater accuracy. IFTA Final Use Tax Rate and Rate Code Table 2 - 2nd Quarter 2022. New York State imposes a highway use tax HUT on motor carriers operating certain motor vehicles on New York State public highways excluding toll-paid portions of the.

If you are receiving this message you have either attempted to use a bookmark. IFTA Final Use Tax Rate and Rate Code Table 2 - 1st Quarter 2022. These are carriers that operate vehicles across New York State public.

IFTA Final Use Tax Rate and Rate Code Table 2 - 2nd Quarter 2022. The Federal Heavy Vehicle Use Tax HVUT is required and administered by the Internal Revenue Service IRS. The state of New York applies its own HUT highway use tax for many different motor carriers.

Federal law requires proof that the HVUT tax was paid when you register a. Highway Use Tax TB-HU-360 August 1 2014 How to Determine Your Highway Use Tax.

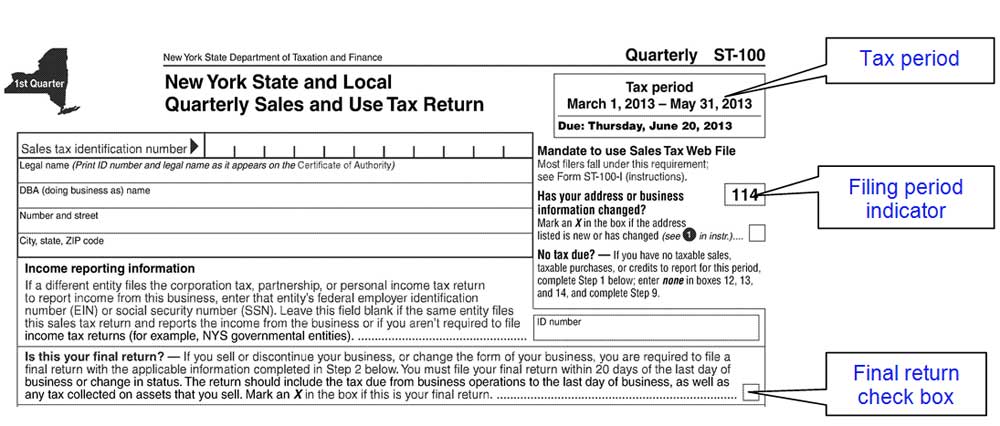

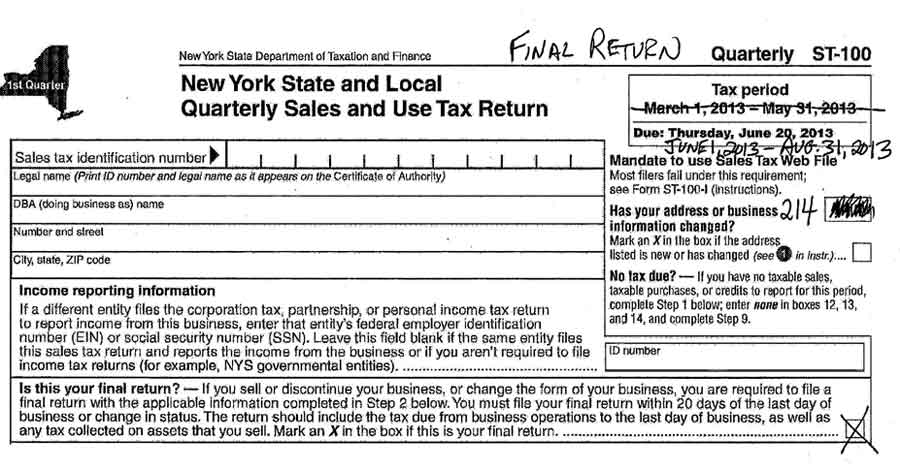

Filing A Final Sales Tax Return

Fuel Taxes In The United States Wikipedia

Filing A Final Sales Tax Return

Nyc Dot Trucks And Commercial Vehicles

Ny Highway Use Tax Form Fill Out And Sign Printable Pdf Template Signnow

Mta Closer To Congestion Pricing Toll Of Up To 23 Per Vehicle Trip Into Manhattan The City

I 64 Construction Projects Cause Ramp Closures In Louisville

Sales Tax Software Solving Sales And Use Tax For Good Sovos

New York Hut Mileage And Highway Use Tax

2021 Sales Tax Rates State Local Sales Tax By State Tax Foundation

School Property Tax Rates 20 Highest In Upstate Ny Newyorkupstate Com

Highway Use Tax Form 2290 Hut 888 669 4383

Florida Car Sales Tax Everything You Need To Know

Gas Tax Rates By State 2021 State Gas Taxes Tax Foundation

This Road Work Made Possible By Underfunding Pensions The New York Times

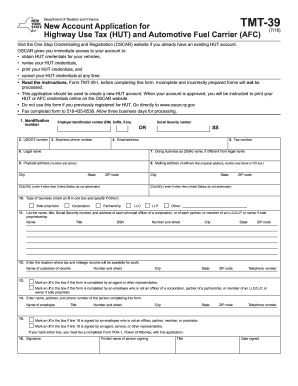

Tmt 39 Fill Out And Sign Printable Pdf Template Signnow

New York Usa 05th June 2022 Gas Prices Are Advertised At A Shell Gas Station After New York Governor Kathy Hochul Announced That The State Is Suspending The 16 Cents Per Gallon Gas Tax